Expanding access to non-traditional investments

aditum (ah-dee-tum): Latin, meaning “access”

Contact us to schedule a call. We can explore your investment product plans together.

Mission

Mission

Aditum Alternatives’ mission is to expand private and individual investor access to non-traditional investments.

We advise clients on the design, engineering, operation and distribution of alternative, non-traditional investment products, and develop intellectual property for our clients’ use.

Aditum Aqueduct

Private

Private Markets

“By reducing overall portfolio volatility and enhancing yield stability, private assets could have much to offer at a time of public market turbulence and lower return expectations for traditional asset classes.”1

“Increased access to private equity is also drawing keen interest from individuals and their advisers.

Not only are private equity’s historically superior returns attractive (14% globally over the past 25 years vs. 7% for the MSCI World Index), but true diversification in the public markets has become harder to achieve over time.”2

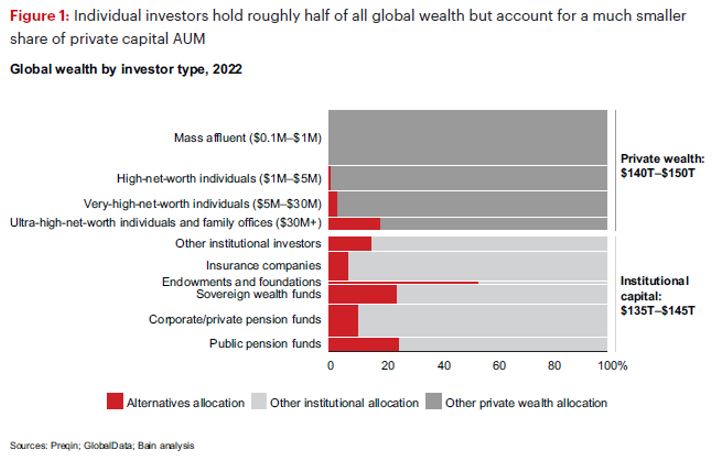

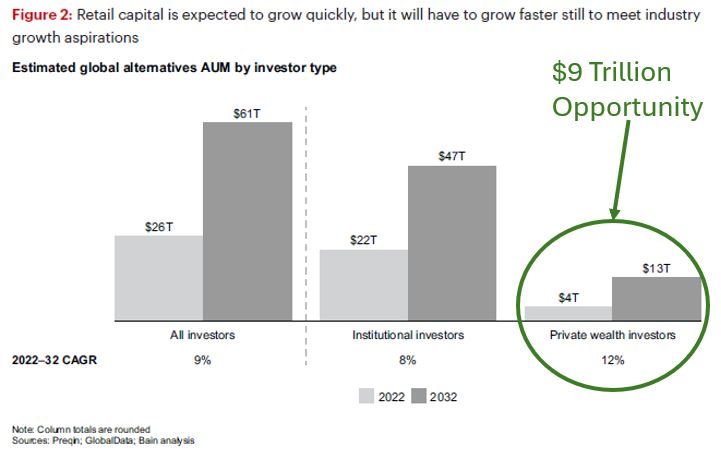

As shown in the figures below3,2, private market investment products for individuals are a $9 Trillion opportunity over the next decade

1The Retailization of Private Markets in Alternatives, BNY Mellon 2024

2Why Private Equity Is Targeting Individual Investors, Bain 2023

3Why Private Equity Is Targeting Individual Investors, Bain 2023

Articles

Articles

Is the Future of Digital Assets on the November Ballot?

Investors Beware: Interval Funds Are Not ‘Less Liquid’ Mutual Funds

A Tokenized Future Calls for Compromise – and a Few Watershed Events

Tokenization: The Forecast Is Partly Sunny, Despite an SEC Cloud

Re: Proposed Amendments to ’34 Act Rule 3b-16 and the Definition of Exchange

The SEC’s Big Private Markets Opening: Intermediation and Blockchain

Private Equity Outperformance Remains Elusive for Individuals

Private Equity Innovation Is Needed. Will Disruption Follow?

Private Equity: The Power of When

Measuring Private Equity Returns: I’m with Warren Buffet (almost)

Re: SEC Proposed Rule 18f-4 and Unfunded Commitments

Registered PE: From Cash Drag In 2018 Toward Default In 2020

Private Equity, Unfunded Commitments, And The SEC

Re: SEC Concept Release on Offering Exemptions

Private Market Investing: RORs, Warren Buffett And Investor Choice

Individual Investors, Private Equity And The Need For Liquid Assets

Expanding Individual Investor Access To Private Equity

Why Structure Matters, Part 4: Tax Considerations

Why Structure Matters, Part 3: Leverage

Why Structure Matters, Part 2: Liquidity

Why Structure Matters

Ken McGuire

Press

Press

September 18 2024, FundFire Alts – Mind the Cash: Hot Buyout, Infra Semi-Liquid Funds Face Deployment Crunch

February 14 2024, FundFire Alts – Do Semi-Liquid Alts Funds Need a Performance Reporting Reset?

November 29 2023, FundFire Alts – Apollo, JP Morgan: Tokenization Can Bring Alts into Model Portfolios

November 1 2023, FundFire Alts – Hamilton Lane Drops Bid to Tokenize Registered Alts Fund

July 26 2023, FundFire Alts – Hamilton Lane Tokenization Push Highlights Hard Road to SEC Approval

April 19 2023, FundFire Alts – KKR Launches Private Equity Vehicle for Advisor Market

April 5 2023, FundFire Alts – Long SEC Review Pushes Hamilton Lane to Delay Digital Product Launch

May 25 2022, FundFire Alts – More Venture Products for Advisors Move to Market

Mar 2 2022, FundFire Alts – LaSalle Moves to Blockchain System for $77B in Real Estate Assets

Feb 3 2022, Regulatory Compliance Watch – SCOTUS decision scrambles pension managers

Jan 5 2022, PR Newswire – Aditum Alts Files Patent At Nexus of Private Markets and Blockchain

Jul 28 2021, FundFire – Opinion: Private Equity Outperformance Remains Elusive for Individuals

Jun 30 2021, PR Newswire – Aditum Alts Files Patent On Private Market Commitment System

Jan 7 2021, PR Newswire – Aditum Alts Responds to Recent SEC Rules with Private Market Patent

Oct 28 2020, FundFire – Will Advisors Jump On New, Winding Roads to Illiquid Alts?

Oct 8 2019, PR Newswire – Aditum Alts Files Enhanced Patent on Private Market Fund Innovations

Sep 25 2019, InvestmentNews – Experts warn SEC about perils of loosening private offering rules

Apr 3 2019, PR Newswire – Aditum Alts Files Patent on Private Market Focused Fund Innovations

Founder

Founder

Ken McGuire has extensive alternative investment experience, starting with his tenure at Commodities Corporation, a firm that launched the careers of many notable hedge fund investors.

Subsequently, Ken served as the Co-Head of Operations, Finance and Technology, Chairman of the Operations Committee, and a member of the Management Policy Committee for Goldman Sachs’ Hedge Fund Strategies group.

More recently, Ken was President and Chief Operating Officer of Altegris, where he was a member of the Investment Committee and led the launch of innovative alternative investment products used by investors having a wide range of wealth levels and investment objectives.

Ken founded Aditum Alternatives in 2017.

Content

Contact